Revised Tax Audit Report: Deadlines and Important Precautions

However, in some cases, after submitting the audit report, a taxpayer may identify an omission or make a payment that impacts certain deductions. This raises an important question — can the tax audit report be revised?

The Applicable Legal Rule

Previously, there was no specific provision allowing the revision of an audit report once it had been submitted. However, this changed with the introduction of the Income-tax (Eighth Amendment) Rules, 2021, which inserted Rule 6G(3). The sub-rule allows the revision of a tax audit report under the following circumstances:

"There is payment by such person after furnishing of the report under sub-rule (1) or (2) which necessitates a recalculation of disallowance under section 40 or section 43B." This provision allows a taxpayer to obtain a revised audit report from the same Chartered Accountant (CA), duly signed and verified, and submit it before the end of the relevant assessment year if any subsequent payment affects disallowances under Sections 40 or 43B.

When is Income Tax Audit Report Revision Permitted?

The law permits revision only under specific and bona fide circumstances:

- Payments Made After the Audit Date - When a taxpayer makes payments of statutory dues such as GST, TDS, PF, or interest after filing the original report, which impact deductions under Sections 40 or 43B.

- Correcting Genuine Errors - In cases involving clerical errors, incorrect clause references, or misclassified data entries.

- Revised financial statements – When a company or partnership reopens or restates its financial accounts.

- Impact of Retrospective Law Changes or Judicial Rulings - Impacting the disallowances reported earlier.

- Addressing Technical or Utility Issues - Where the e-filing system or audit utility required re-uploading corrected data.

The ICAI’s Guidance Note on Tax Audit under Section 44AB clarifies that audit report revisions should not be done routinely. Any revision must be properly justified, well-documented, and clearly cross-referenced to the original report.

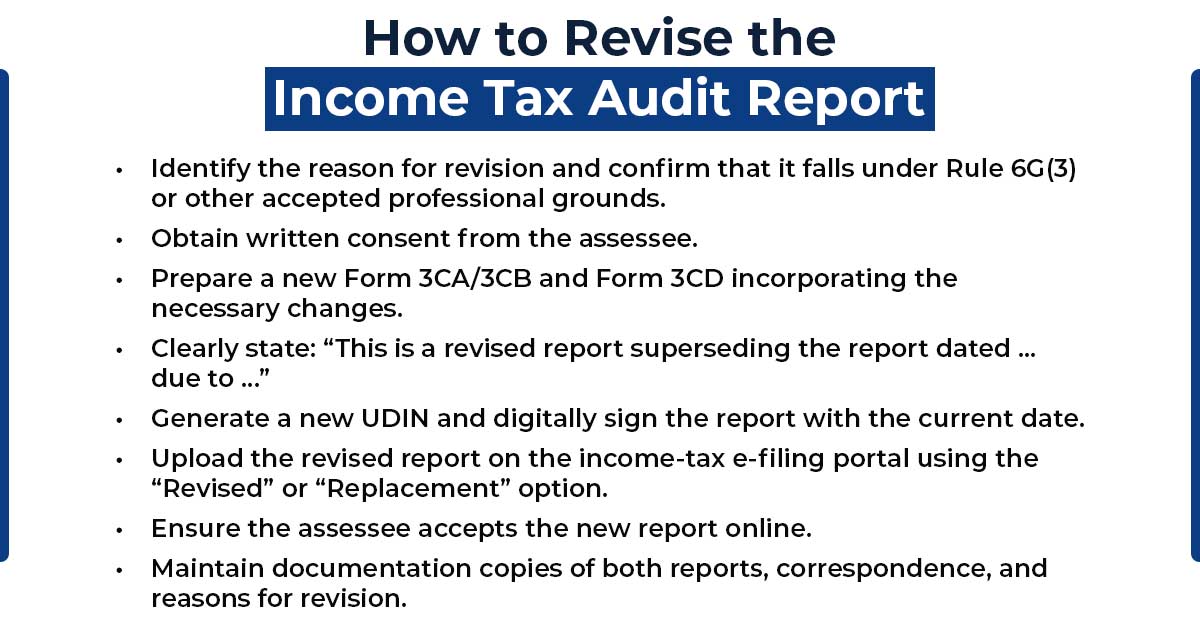

Who Can Revise the Income Tax Audit Report?

Only the original auditor who submitted the initial report is authorised to issue the revised version. The revised report must include a new date, signature, and a fresh UDIN (Unique Document Identification Number).

If the original auditor has resigned, retired, or ceased to practice, the succeeding auditor cannot 'revise' the previous report. Instead, they must issue a new audit report following a fresh appointment and independent audit procedures.

The Applicable Time Limit

The revised audit report must be submitted before the conclusion of the relevant assessment year. Beyond this period, further revisions are generally not permitted unless specifically allowed by the Assessing Officer.

Key Cautions for Audit Report Revision

- A revised tax audit report does not automatically update the Income Tax Return (ITR). The taxpayer must file a separate revised ITR, referencing the details of the updated audit report.

- Frequent or unjustified revisions may lead to professional scrutiny or disciplinary action under the Chartered Accountants Act, 1949.

- The revised report fully supersedes the previous one and is treated as the valid audit report on record.

- The reason for the revision must be clearly stated in the new report and properly cross-referenced to the original report.

- If the revision alters any qualification or observation, it should be thoroughly reviewed and clearly justified in the revised report.

Illustrative Example

For example, if a business files its audit report and later makes a payment for an employee bonus or other statutory dues that were previously disallowed under Section 43B, the Chartered Accountant may issue a revised report. This updated report reflects the correct figures and ensures compliance while avoiding potential penalties.

However, if the revision is only to correct minor wording or unrelated data, it may not qualify as a valid reason for revision and should generally be avoided.

Final Thoughts

Revision of a tax audit report is legally permitted but subject to specific conditions. As per Rule 6G(3), it is allowed only when a subsequent payment impacts disallowances under Sections 40 or 43B. Apart from these cases, only genuine and properly documented reasons are considered valid for revision.