Offline Tax Filing with Latest ITR-1 & 4 Excel Utilities

For ITR-1 and ITR-4 forms for the Assessment Year 2025-26, the Income Tax Department has released the Excel utilities. Income tax returns for income made in FY 2024-25 can now be filed by the salaried individuals, freelancers, small business owners, and pensioners from the same proceeds.

On the official income tax e-filing portal (https://incometax.gov.in), the utilities are available and they authorize taxpayers to fill and submit their return offline before uploading it on the portal.

Who is Eligible to Use ITR-1 and ITR-4?

- ITR-1 (Sahaj): This form is intended for resident individuals whose total income does not exceed Rs 50 lakh. Eligible sources of income include salary, income from one house property, interest earnings, or pension.

- ITR-4 (Sugam): The form is for individuals, HUFs, and firms (other than LLPs) with income up to Rs 50 lakh via business or profession under presumptive taxation.

New This Year: Taxpayers who have long-term capital gains up to Rs 1.25 lakh from listed equity shares can now report this income in ITR-1 and ITR-4, rather than ITR-2, as was needed before.

What is the Utility of Excel?

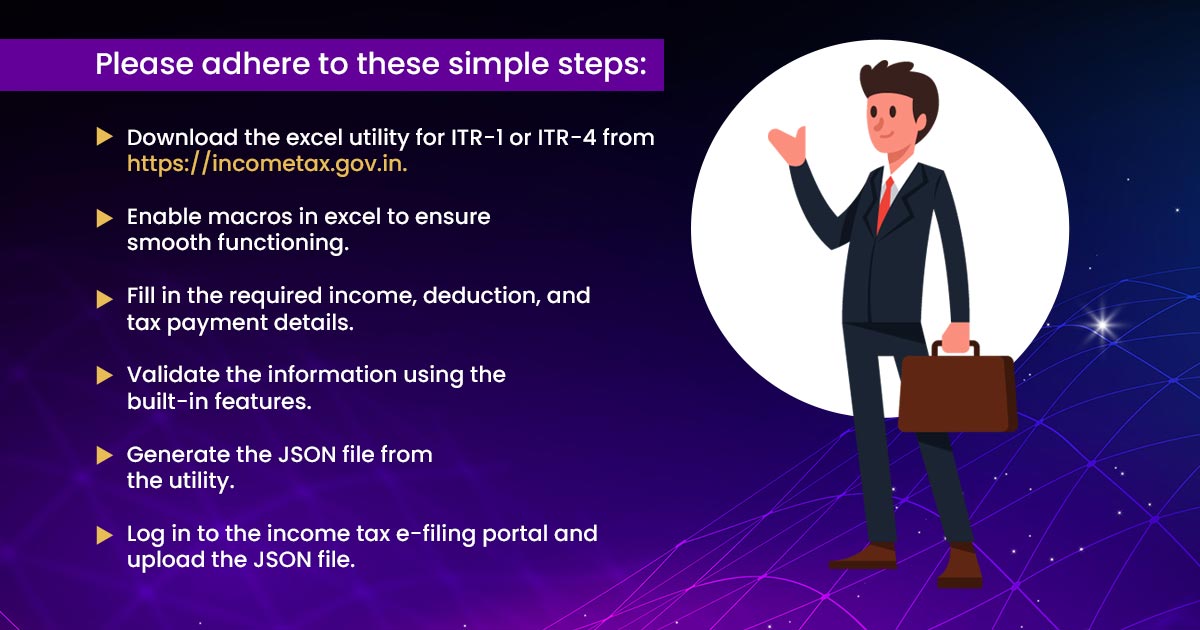

The Excel utility is an offline tool that supports taxpayers in filling in the needed information for their returns, even for those who do not have an internet connection. The file, after being filled out, can be validated and then uploaded to the income tax portal.

What is the Method to Use the Excel Utility?

Important Deadlines and Notifications

- ITR-1 and ITR-4 Filing Deadline: September 15, 2025. This year, the deadline has been extended beyond July 31 due to structural modifications in the forms.

- Keep your income documents, TDS certificates, Form 26AS, and AIS prepared before filing.

What is the Reason for the Delay in Release?

On April 29, 2025, the forms were notified, and the release of the utilities will take a month. As per the department, the same is because of the structural and content revisions in the forms, which need additional development and system integration time.

The Excel utility for those with complex income proposes an easier way to comply with the tax liabilities. Ensure to file before the due date lapses to prevent last-minute errors.