Gen Complaw Compliance Software for LLP & ROC Forms

October 18, 2023 at 5:24 pm,

No comments

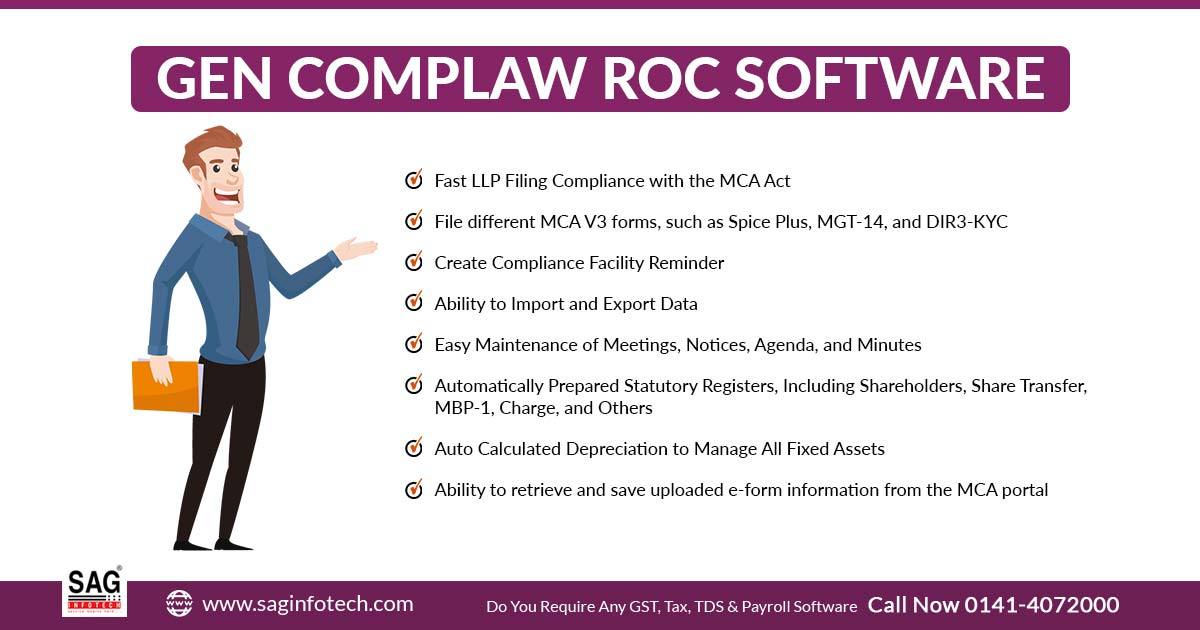

Gen CompLaw ROC Software is a comprehensive solution for filing MCA V3 e-Forms, XBRL, Resolutions, Minutes, Registers, and MIS reports. It is the best tool to take away your hassle and can simplify the intricate process of filing these forms. Businesses can ensure correct and timely XBRL E-Filings adhering to the Companies Act, 2013 statutory compliance. Along with its user-friendly interface, its quick response makes it stand out from others tackling important tasks.

This software is built with cutting-edge technology and studded with some outstanding features like MCA/ROC filing complying with government regulations. Gen CompLaw software is capable of filing various e-forms such as AOC-4, MGT-7, MGT-7A, ADT-1, LLP e-forms (3,8,11,12,15), and some other forms. It simplifies the task of filing by the Companies Act 1956/2013. Gen CompLaw ROC filing software is capable of generating essential statutory registers like Shareholders, Share Transfer, MBP-1, and Charge, furnishing a complete solution for seamless record management.

In the domain of tax software, Gen CompLaw ROC stands out as an invaluable resource for both individuals and businesses, providing a seamless online e-filing experience. It surpasses traditional tax software by incorporating ROC filing and MCA filing options. ROC, which stands for Return on Capital, assesses a company's effectiveness in utilizing invested capital.

Gen CompLaw's XBRL software simplifies ROC e-forms, XBRL submissions, Resolutions, Minutes, Registers, and various MIS reports. Created by SAG Infotech, this ROC/MCA Return Filing Software is well-known for its efficiency, speed, and reliability. This tool presents a dependable and efficient solution for businesses looking to streamline their filing processes and ensure compliance with statutory requirements. If you're in search of ROC filing software, don't hesitate; to explore the possibilities today with Gen CompLaw and XBRL by trying out our free trial version. Embrace this powerful tool and unlock the potential of the future of taxation.

Starting on January 23, 2023, Where Should I Submit Company Incorporation Forms?

The Ministry of Corporate Affairs (MCA) is currently in the process of enhancing its online portal from Version 2 to the more advanced Version 3. As of the date of this FAQ, it's important to mention that Version 3 is currently operational exclusively for Limited Liability Partnerships (LLP). Here's what Version 3 has to offer for LLPs:

- Login and user Registration.

- DSC Association

- LLP Form Filing

What Are the Most Notable Differences Between MCA V2 & V3?

In Version 2, users had to fill out forms offline and then upload them to the platform. However, in Version 3, you can conveniently complete the forms online, significantly enhancing user-friendliness. This feature allows you to save partially completed forms and resume work at a later time.

Furthermore, Version 2 featured a "My Workspace" function for viewing announcements and circulars from the MCA. In contrast, Version 3 introduces the "My Application" feature, which is personalized and enables you to review all the forms you've submitted to date. This feature also empowers you to monitor the progress of these forms, including whether they are pending further processing, require DSC uploads, need fee payments, or necessitate resubmission, among other aspects.

In Version 3, the login process involves using your email address for authentication, whereas Version 2 allows the use of a user ID. Business users accessing the MCA system will receive a one-time password (OTP) sent to both their mobile number and email address to verify their identity.

It's important to note that there is no difference between Version 2 and Version 3 regarding how Digital Signature Certificates (DSCs) are linked.